“The only useful financial innovation in the last 20 years is the ATM.”

That was former Federal Reserve Chairman Paul Volcker’s assessment in the aftermath of the 2008 Global Financial Crisis, spurred on by complex products like credit default swaps and collateralized debt obligations.

There is a lot of truth in Volcker’s quip. As a general rule, the more complicated the “investment solution” you’re being pitched, the faster you should run in the opposite direction. (One of my most popular blogs ever, The Game is Rigged Against You, explains why.)

Our industry is filled with smart, creative people, which means product innovations are constant. The vast majority of which have ranged from “meh” to “whoever invented this should go to jail.” Almost always, these “solutions” are pushed on investors to solve problems they don’t have while lining the pockets of the salesman.

But, finally, we have a truly great innovation for investors: The §351 Exchange.

I know, tax codes and SEC rules aren’t exactly page-turners, but bear with me—this leads somewhere exciting.

§351 of the Internal Revenue Code was signed into law in 1954. It allowed for tax-deferred contribution of property to a corporation in exchange for stock. For the last ~70 years, §351 was primarily used in the formation or restructuring of corporations.

More recently, the SEC adopted the “Active ETF Rule” making it easier to launch active ETFs and allowing for more flexible ETF operations.

Here’s the exciting part I promised—combine these two obscure bits of federal policy, and you get the most useful investment innovation of my career.

Investors can now contribute the “unloved” parts of their portfolio and receive shares of a new ETF, without incurring any taxes.

Why would you want to do this? And what do I mean by “unloved”?

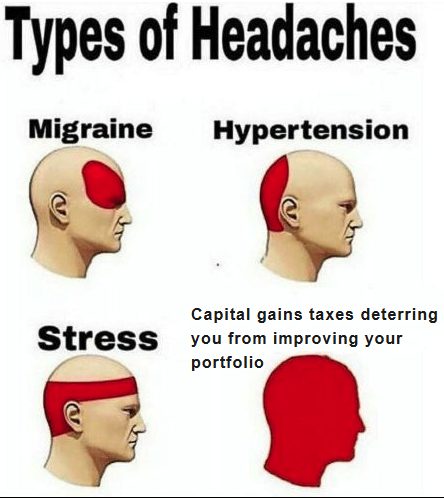

- Maybe you have a handful of individual stocks that you purchased long ago. You don’t want to sell them and incur capital gains taxes, but you’ve lost conviction or simply don’t care to manage them anymore.

- Maybe you have a concentrated position in your employer’s stock. (While specific diversification rules apply, the §351 exchange can still help reduce your risk.)

- Maybe you have funds that you purchased years ago but cheaper or better alternatives exist today.

- Maybe your portfolio is a hodgepodge of varying investment ideas lacking a cohesive strategy.

- Maybe you’ve questioned if your portfolio still aligns with your financial goals but have been paralyzed by the tax hit associated with making a change.

Ultimately, this game-changing innovation lets investors realign their portfolios without triggering capital gains taxes. (If you later sell the ETF you received, you could incur capital gains. Your original cost basis carries through to the ETF.)

Of course, certain rules must be followed to take advantage of the §351 exchange’s tax deferral. The timing must be right, proper execution is critical, and most importantly, investors must understand the strategy of the ETF that they’re receiving. In other words, it takes more due diligence than an ATM, but the juice can be well worth the squeeze.

For years, investors have been stuck holding positions they no longer believe in—not because they want to, but because selling would trigger a painful tax bill. The §351 exchange fixes that. It lets investors reshape their portfolios without realizing capital gains, clearing out legacy holdings and moving forward with intention. The ATM era may be ending, but the §351 exchange has arrived as the kind of practical, investor-first innovation we rarely see. We’re already using it for our clients. If you’re wondering if it might be right for you, please reach out. I’d be happy to help you explore your options.

Disclaimer: Truepoint Wealth Counsel is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training nor an endorsement by the SEC. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at TruepointWealth.com. Neither the information, nor any opinion expressed, is to be construed as personalized investment, tax or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed. You cannot invest directly in an index.